401k paycheck impact calculator

Tennessee residents pay the highest overall sales tax nationwide with rates ranging from 850 to 975 depending on where you live. If your employer offers a 401k match invest everything you.

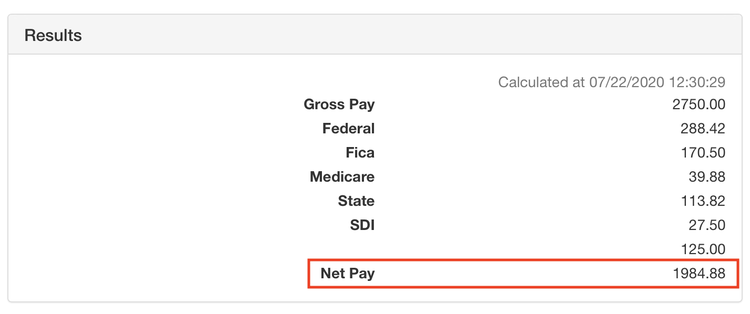

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Investment Calculator is a beautifully simple calculator to help you calculate the potential value of your retirement investments and visualize their growth.

. Long Term Disability Insurance Life Insurance. The rest is withheld from your bonus. Start your 401K investment in 1 year.

These two tax-advantaged retirement plans are designed. 0 Your Yearly Tax Savings. Start your 401K investment now.

Maximize employer 401k matching. Using our retirement calculator. 0 Your Take Home Pay Only Changes By.

Since your Roth 401k contributions are made after-tax youre paying taxes now and taking home a little less in your paycheck. The salary calculator converts your salary to equivalent pay frequencies including hourly daily weekly bi-weekly monthly semi-monthly quarterly and yearly. See the potential impact of changes with our dashboard and projection tools.

When your bonus is included in your regular paycheck things get complicated. Based on your inputs we also make suggestions on how to increase your investment savings. Plan employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck.

First your employer calculates the normal withholding amount for your entire paycheck. SmartAssets Oregon paycheck calculator shows your hourly and salary income after federal state and local taxes. Use Fidelitys 401k match calculator to find out how matching contributions can impact your retirement savings.

Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K. Then it subtracts what was withheld from your last paycheck from your current withholding. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

The IRS contribution limit increases along with the general cost-of. There are a few other deductions that can impact the size of your paychecks. While you wont feel a significant impact from a traditional state income tax in Tennessee the downside is that Tennessee sales tax rates deal a tough hit to taxpayers cash flows during the year.

Whatever amount you need to put in to get the maximum 401k contribution from the employer start there Arrigo said. Heres how time and compounding impact a 5000 pretax yearly contribution when saving starts at various ages. Payroll calculator tools to help with personal salary retirement and investment calculations.

Vesting and Employer 401k Contributions Some 401k plans include a vesting. How 401k Contributions Affect Your Paycheck. Payroll 401k and tax calculators.

Understand the impact of taking out a loan on your 401k. 1 5000 annual contributions on January 1 of each year for the age ranges shown 2 an annual rate of return of 7 and 3 no taxes on any earnings within the qualified retirement plan. Customize the salary calculator by including or excluding unpaid time such as vacation hours or holidays.

This hypothetical example assumes the following. If you pay for any benefits from your employer such as health or life insurance. If you choose to modify your paycheck or unenroll assets you can see the impact on your portfolio over time.

Employers offer 403b and 401k plans to help their employees save for retirement but chances are you wont have to choose between them. Print your results. Pretax traditional 401k contributions are taken off the top of your gross earnings before your paycheck is taxed which will lower your tax bill for the year.

So why would anyone choose a Roth 401k if it means they. Then every time you get a raise increase your contribution by 1.

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Microsoft Apps

Free 401k Calculator For Excel Calculate Your 401k Savings

A Small Business Guide To Doing Manual Payroll

401k Contribution Impact On Take Home Pay Tpc 401 K

How To Use A Rent Vs Buy Calculator Forbes Advisor

/GettyImages-155379499-a7f64925872c4efcb1923a6e64249736.jpg)

Can Your 401 K Impact Your Social Security Benefits

401 K Calculator Paycheck Tools National Payroll Week

401k Calculator

401k Calculator Paycheck Hotsell 53 Off Gasabo Net

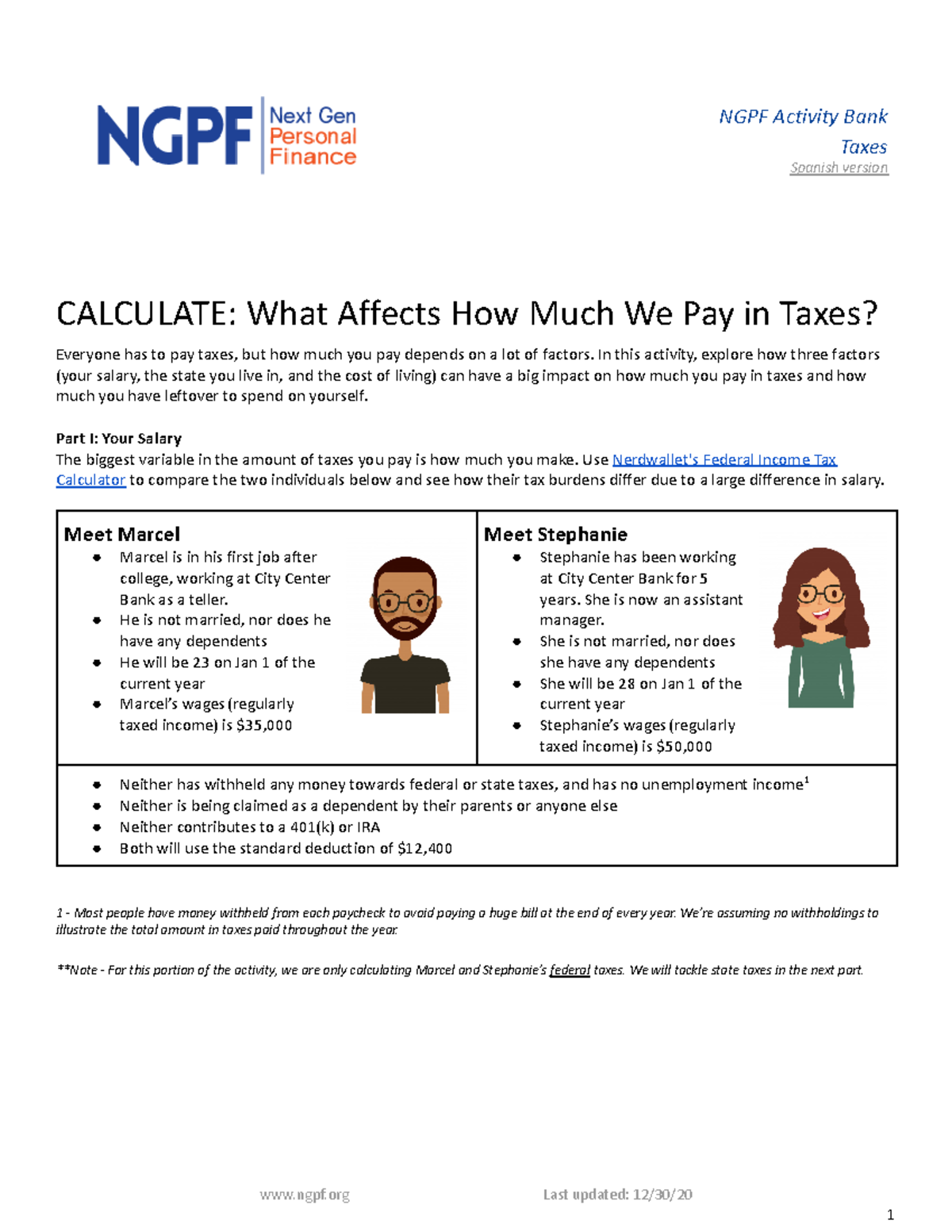

Copy Of Copy Of Calculate What Affects How Much We Pay In Taxes Hbsmba 1935 2 Harvard Studocu

Monthly Gross Income Calculator Freeandclear

Lowest 401k Match Ever R Personalfinance

401 K Plan What Is A 401 K And How Does It Work

Free 401k Calculator For Excel Calculate Your 401k Savings

Free 401k Calculator For Excel Calculate Your 401k Savings

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full